Voting Stockholders may vote by: You are cordially invited to attend the Annual Meeting. Whether you own a few or many shares and whether you plan to attend the Annual Meeting in person or not, it is important that your shares be voted on matters that come before the Annual Meeting. Your vote is important.

By Order of the Board of Directors,

/s/ Micah Goodman

Micah Goodman

Secretary

BENEFIT STREET PARTNERS REALTY TRUST, INC.

TABLE OF CONTENTS

| | | | | Online attend Annual Meeting virtually Information www.virtualshareholdermeeting.com /FBRT2023 |

| | | | | | FRANKLIN BSP REALTY TRUST | | 1 | | 2023 PROXY STATEMENT |

2022 Financial Highlights | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Annual dividend, paid quarterly, of $1.42 delivering a yield of ~9% on 12/31/22 book value | | | |

| | | | Total loan commitments of $2.3B at a weighted average spread of 462 bps | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Issued two managed CLOs, raising over $2.0B | | | |

| | | | Commercial real estate portfolio ended 2022 at $5.3B in principal balance spread over 161 loans | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Produced full year GAAP and Distributable Earnings ROE* of (0.3)% and 6.6%, respectively | | | |

| | | | Ended 2022 with total liquidity of $1.0B | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Corporate Governance Highlights | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Adoption of director and officer stock ownership guidelines in 2022 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 86% of Board nominees are independent | | | |

| | | | Lead Independent Director | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 43% of Board nominees are gender or racially diverse | | | |

| | | | Majority vote standard with resignation policy and annual election of directors | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Annual Board and committee evaluations | | | |

| | | | Say on Pay proposal on the ballot this year | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Corporate Social Responsibility Highlights | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Corporate Environmental Policy adopted | | | |

| | | | Published inaugural SASB report | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | ESG oversight provided by the Nominating and Corporate Governance Committee | | | |

| | | | Anti-Bribery and Anti-Corruption Policy adopted | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Regular stockholder engagement on ESG and related matters | | | |

| | | | Political and Charitable Contributions Policy adopted | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

*Please use the Appendix to this proxy statement for a reconciliation of non-GAAP financial measures to our results as reported under GAAP. | | | | | | FRANKLIN BSP REALTY TRUST | | 2 | | 2023 PROXY STATEMENT |

| Page

| | | | | |  | | |

| | | | | | |  | | |

BENEFIT STREET PARTNERSFRANKLIN BSP REALTY TRUST, INC.

9 West 57thStreet,1345 Avenue of the Americas, Suite 492032A

New York, New York 1001910105 PROXY STATEMENT FOR 2023 ANNUAL MEETING OF STOCKHOLDERS TheTO BE HELD May 31, 2023

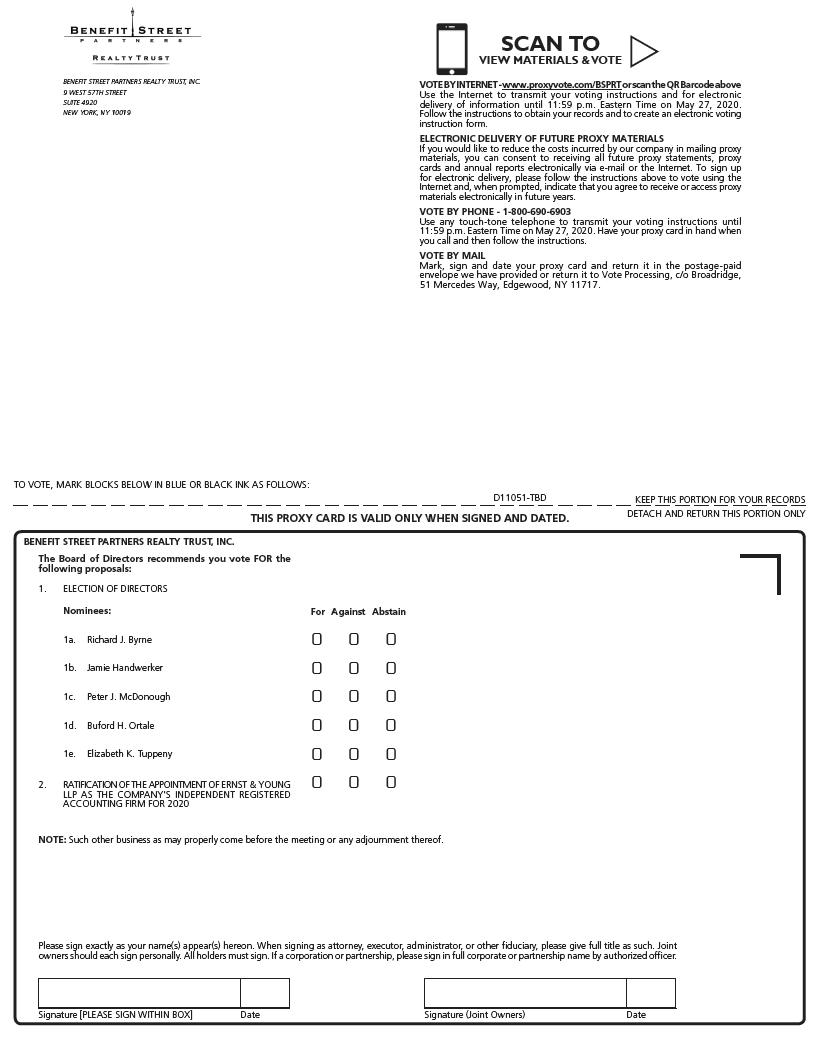

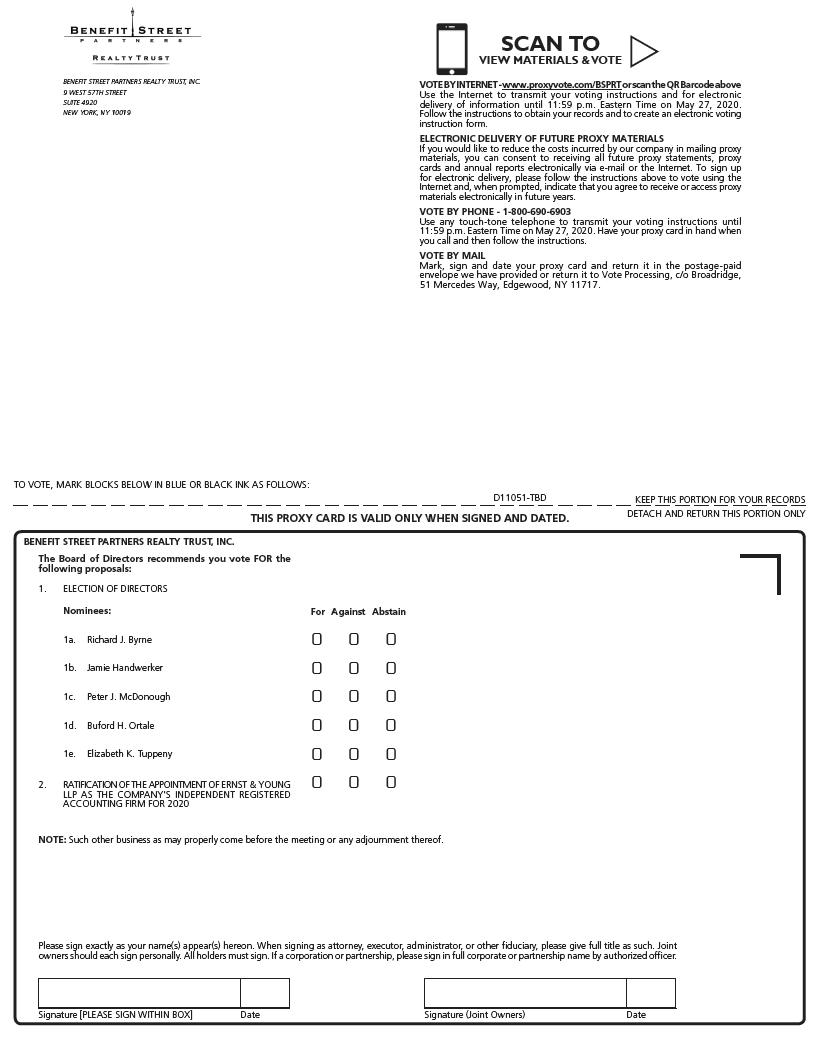

This proxy card, mailed together with this proxy statement (this “Proxy Statement”) and our Annual Report on Form 10-K for the year ended December 31, 2019 (the “2019 Annual Report”), is solicitedbeing furnished by and on behalf of the board of directors (the “Board of Directors” or the “Board”) of Benefit Street PartnersFranklin BSP Realty Trust, Inc., a Maryland corporation, (the “Company”(“the Company”, “FBRT”, “we”, “us” or “our”), for usein connection with the solicitation of proxies to be voted at the 2020Company’s 2023 Annual Meeting of Stockholders (the “Annual Meeting”) and at any adjournment or postponement thereof. References in this Proxy StatementWe are furnishing the proxy materials for the Annual Meeting electronically using the Internet through the mailing to “we,” “us,” “our,” “our company,” or like terms refer to the Company, and references in this Proxy Statement to “you” refer to theour stockholders of the Company. The mailing addressa Notice of our principal executive offices is 9 West 57thStreet, Suite 4920, New York, New York 10019. ThisInternet Availability of Proxy Statement,Materials, or the Notice of Annual Meetingand Access Card. The proxy statement, proxy card and our 2019 Annual Report have either been mailed2022 annual report to youstockholders will be distributed or made available to you on the Internet. Mailing to our stockholders commencedof record on or about April 3, 2020. [●], 2023. Important Notice Regarding the Availability of Proxy Materials for the Annual Stockholders Meeting to be Held on Thursday,Wednesday, May 28, 2020 31, 2023 This Proxy Statement, the Notice of Annual Meeting and our 20192022 Annual Report are available at: www.proxyvote.com/BSPRT

www.ProxyVote.com/FBRT In addition, any stockholder may request to receive proxy materials electronically by email on an ongoing basis. Choosing to receive proxy materials by email saves the Company the cost of printing and mailing documents to stockholders and will reduce the impact of annual meetings on the environment. A stockholder’s election to receive proxy materials by email will remain in effect until the stockholder terminates it. *** Certain statements in our proxy statement, other than purely historical information, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements are based on current expectations and assumptions of management that are subject to risks and uncertainties that may cause actual results to differ materially from our expectations. Our forward-looking statements are subject to various risks and uncertainties, including but not limited to the risks and important factors contained and identified in our filings with the SEC, including our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, any of which could cause actual results to differ materially from the forward-looking statements. The forward-looking statements included in this proxy statement are made only as of the date hereof. Please see “Forward-Looking Statements” in the 2022 annual report for more information. | | | | | | FRANKLIN BSP REALTY TRUST | | 1 | | 2023 PROXY STATEMENT |

INFORMATION ABOUT THE MEETING AND VOTING What is the date of the Annual Meeting and where will it be held? The Annual Meeting will be held on Thursday,Wednesday, May 28, 2020,31, 2023, commencing at commencing at 10:11:00 A.M. (Eastern time) at the offices of Hogan Lovells US LLP, 390 Madison Avenue, New York, NY, 10017. While we intend to hold the. The Annual Meeting will be held in person, we are actively monitoringvirtual format only. Why did I receive a notice in the coronavirus (COVID-19) situation. Inmail regarding the event it is not possible or advisable to hold the Annual Meeting in person, we will announce the alternative meeting arrangements inInternet availability of proxy materials instead of a press release filed with thepaper copy of proxy materials? The United States Securities and Exchange Commission (the “SEC”) has approved “Notice and Access” rules relating to the delivery of proxy materials over the Internet. These rules permit us to furnish proxy materials, including this proxy statement and our annual report, to our stockholders by providing access to such documents on the Internet instead of mailing printed copies. Most stockholders will not receive paper copies of the proxy materials unless they request them. Instead, the Notice and Access Card, which will be mailed to our stockholders, provides instructions regarding how you may access and review all of the proxy materials on the Internet. The Notice and Access Card also instructs you as promptly as practicable.to how you may authorize your proxy via the Internet or by telephone. If you would like to receive a paper or email copy of our proxy materials, you should follow the instructions for requesting such materials printed on the Notice and Access Card. Can I vote my shares by filling out and returning the Notice and Access Card? No. The Notice and Access Card identifies the items to be voted on at the Annual Meeting, but you cannot vote by marking the Notice and Access Card and returning it. The Notice and Access Card provides instructions on how to authorize your proxy via the Internet or by telephone or vote in person at the Annual Meeting or to request a paper proxy card, which will contain instructions for authorizing a proxy by the Internet, by telephone or by returning a signed paper proxy card. How can I participate at the virtual Annual Meeting? The Annual Meeting will be conducted via live webcast. You are encouragedentitled to monitor our website atwww.bsprealtytrust.comparticipate in the Annual Meeting only if you were a stockholder as of the close of business on April 10, 2023 or if you hold a valid proxy for updated information about the Annual Meeting. You may attend the annual meeting live online at www.virtualshareholdermeeting.com/FBRT2023. If you virtually attend the annual meeting you can vote your shares electronically, and submit your questions during the annual meeting. To participate in the Annual Meeting, you will need the 16-digit control number included on your proxy card or on the voter instruction form that accompanied your proxy materials. The meeting webcast will begin promptly at 11:00 a.m. Eastern Time on May 31, 2023. Online access will begin at 10:45 a.m. Eastern Time, and we encourage you to access the meeting prior to the start time. Will I be able to participate in the online annual meeting on the same basis I would be able to participate in a live annual meeting? Yes. We designed the format of the online annual meeting to ensure that our stockholders who attend our annual meeting will be afforded the same rights and opportunities to participate as they would at an in-person meeting and to enhance stockholder access, participation and communication through online tools. If you were a stockholder as of the close of business on April 10, 2023 and access the Annual Meeting using the 16-digit control number included on your proxy card or on the voter instruction form that accompanied your proxy materials, you can submit questions electronically at the Annual Meeting during the webcast. During the live Q&A session of the meeting, members of our executive leadership team and our Chairman of the Board will answer questions as they come in, as time permits. To ensure the meeting is conducted in a manner that is fair to all stockholders, the Chairman (or such other person | | | | | | FRANKLIN BSP REALTY TRUST | | 2 | | 2023 PROXY STATEMENT |

designated by our Board) may exercise broad discretion in recognizing stockholders who wish to participate, the order in which questions are asked and the amount of time devoted to any one question. We reserve the right to edit or reject questions we deem profane or otherwise inappropriate. What will I be voting on at the Annual Meeting? At the Annual Meeting, you will be asked to: | 1. | elect fiveseven directors for a term of one year, until our 20212024 annual meeting of stockholders and until their successors are duly elected and qualify; |

| 2. | approve the amendment of the Charter to eliminate supermajority voting requirements; |

| 3. | ratify the appointment of Ernst & Young LLP (“EY”) as the Company’s independent registered public accounting firm for the year ending December 31, 2020; and2023; |

| 4. | 3.approve an advisory vote on the compensation of our named executive officers; |

| 5. | vote on the frequency of future advisory votes on the compensation of our named executive officers; |

| 6. | consider and act on such matters as may properly come before the Annual Meeting and any adjournment thereof. |

The Board of Directors does not know of any matters that may be considered at the Annual Meeting other than the matters set forth above. Who can vote at the Annual Meeting? The record date for the determination of holders of shares of our common stock, par value $0.01 per share (“Common Stock”), and shares of our Series AH Convertible Preferred Stock, par value $0.01 per share (“Series AH Preferred Stock”), and shares of our Series C Convertible Preferred Stock, par value $0.01 per share (“Series C Preferred Stock,” and together with the Series A Preferred Stock, the “Preferred Stock”) entitled to notice of and to vote at the Annual Meeting, or any adjournment or postponement of the Annual Meeting, is the close of business on March 20, 2020.April 10, 2023. As of the record date, approximately 44,385,162[82,572,550] shares of our Common Stock 40,514and 17,950 shares of our Series A Preferred Stock and 1,400 shares of our Series CH Preferred Stock were issued and outstanding and entitled to vote at the Annual Meeting. Holders of shares of Series H Preferred Stock are entitled to vote on an as-converted basis on each matter upon which the holders of Common Stock are entitled to vote, voting together as a single class. Each share of Series H Preferred Stock is currently convertible into 299.2 shares of Common Stock. How many votes do I have? Each share of Common Stock entitles the holder to one vote on each matter considered at the Annual Meeting or any adjournment or postponement thereof. Each share of Series H Preferred Stock entitles the holder to 299.2 votes (rounded down to the nearest whole number) on each matter considered at the Annual Meeting or any adjournment or postponement thereof. The proxy card shows the number of shares you are entitled to vote. How may I vote? You may vote in person atelectronically during the Annual Meeting on the virtual meeting website, or by proxy. InstructionsThe Notice and Access Card provides instructions on how to authorize your proxy via the Internet or by telephone or vote electronically at the annual meeting or to request a paper proxy card, which will contain instructions for authorizing a proxy by the Internet, by telephone or by returning a signed paper proxy card by mail. Stockholders may vote during the Annual Meeting by following the instructions available on the meeting website during the meeting. Please see “How can I participate at the virtual Annual Meeting” above for instructions on how to participate in person voting can be obtained by calling ourthe virtual meeting. If they request paper copies of the proxy solicitor, Broadridge Investor Communication Solutions, Inc. (“Broadridge”) at (855) 601-2252. Stockholdersmaterials, stockholders may submit their votes by proxy by mail by completing, signing, dating and returning their proxy card in the enclosed envelope. Stockholders also have the following two options for authorizing a proxy to vote their shares: | • | | via the Internet atwww.proxyvote.com/BSPRTFBRTat any time prior to 11:59 p.m. Eastern Time on May 27, 2020;30, 2023; or |

by telephone, by calling 1-800-690-6903 at any time prior to 11:59 p.m. Eastern Time on May 27, 2020.

| • | | 2by telephone, by calling 1-800-690-6903 at any time prior to 11:59 p.m. Eastern Time on May 30, 2023. |

| | | | | | FRANKLIN BSP REALTY TRUST | | 3 | | 2023 PROXY STATEMENT |

For those stockholders with Internet access,Even if you plan to attend the virtual Annual Meeting, we encourage you to authorize a proxy to vote your shares via the Internet or telephone beforehand, a convenient means of authorizing a proxy that also provides cost savings to us that benefit you as a stockholder. In addition, when you authorize a proxy to vote your shares via the Internet or by telephone prior to the Annual Meeting date, your proxy authorization is recorded immediately, and there is no risk that postal delays will cause your vote by proxy to arrive late and, therefore, not be counted. For further instructions on authorizing a proxy to vote your shares, see your proxy card. You may also vote your shares at the Annual Meeting. If you attend the virtual Annual Meeting, you may submit your vote in person,electronically, and any previous votes that you submitted by mail or authorized by Internet or telephone will be superseded by the vote that you cast at the Annual Meeting.

How will proxies be voted? Shares represented by valid proxies will be voted at the Annual Meeting in accordance with the directions given. If the enclosedyour proxy card is signed and returned without any directions given, the shares will be voted “FOR” (i) the election of fiveseven director nominees named in this Proxy Statementproxy statement for a term of one year, until our 20212024 annual meeting of stockholders and until their successors are duly elected and qualify; and (ii) the amendment to the Charter to eliminate supermajority voting requirements; (iii) the ratification of the appointment of EYErnst & Young LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2020. 2023, and (iv) the advisory vote on the compensation of our named executive officers, and “EVERY YEAR” for the frequency of future advisory votes on the compensation of our named executive officers. The Board does not intend to present, and has no information indicating that others will present, any business at the Annual Meeting other than as set forth in the attached Notice of Annual Meeting of Stockholders and this Proxy Statement.proxy statement. However, if other matters requiring the vote of our stockholders come before the Annual Meeting, it is the intention of the persons named in the proxy to vote the proxies held by them in their discretion. How can I change my vote or revoke a proxy? You have the unconditional right to revoke your proxy at any time prior to the voting thereof by (i) submitting a later-dated proxy either by telephone, via the Internet or in the mail to our proxy solicitor at the following address: Vote Processing, c/o Broadridge, Investor Communication Solutions, Inc., 51 Mercedes Way, Edgewood, NY 11717; or (ii) by attendingvoting electronically at the virtual Annual Meeting and voting in person.Meeting. No written revocation of your proxy shall be effective, however, unless and until it is received at or prior to the Annual Meeting. What if I return my proxy card but do not mark it to show how I am voting? If your proxy card is signed and returned without any direction given, your shares will be voted as recommended by the Board. What vote is required to approve each item? There is no cumulative voting in the election of our directors. EachUnder our bylaws, a nominee for director isin an uncontested election shall be elected byto our Board if the affirmative vote ofvotes cast for such nominee’s election exceed the holders of a majority of all shares of stock of the Company entitled to vote who are present in person or by proxy at the meeting.votes cast against such nominee’s election. Each share of our voting stock may be voted for as many individuals as there are directors to be elected and for whose election the share is entitled to be voted. For purposes of the election of directors, abstentionsAbstentions and broker non-votes will count toward the presence of a quorum but are not considered to be votes “cast” and will have no effect on the election of our directors. For the proposal to amend the Charter to eliminate supermajority voting requirements, the affirmative vote of the holders of not less than two-thirds of the shares then outstanding and entitled to vote at the Annual Meeting is required to approve the proposal. Abstentions and broker non-voteswill have the same effect as votes cast against each director. of a vote “against” the proposal. The proposal to ratify the appointment of EY as the Company’s independent registered public accounting firm requires the affirmative vote of at least a majority of all the votes cast on the proposal. For purposes of ratification of the appointment of EY as the Company’s independent registered public accounting firm, abstentions and broker non-votesAbstentions will count towardtowards the presence of a quorum but will have no effect on the proposal. Because the proposal to ratify the appointment of EY as the Company’s independent registered public accounting firm is considered to be a “routine” matter under New York Stock Exchange (“NYSE”) rules, we do not expect there to be any broker non-votes on that proposal. The advisory vote to approve the compensation of the Company’s named executive officers requires the affirmative vote of at least a majority of all the votes cast on the proposal. Abstentions and broker non-votes will count toward the presence of a quorum but are not considered to be votes “cast” and will have no effect on the proposal. | | | | | | FRANKLIN BSP REALTY TRUST | | 4 | | 2023 PROXY STATEMENT |

Because the advisory vote on the frequency of future advisory votes the compensation of the Company’s named executive officers on provides stockholders with the option to vote to hold an advisory vote once every one, two, or three years, an affirmative majority of the votes cast on the proposal may not be reached for any of the frequency options presented. Accordingly, a plurality of the votes cast for the proposal will be considered the stockholders’ preferred frequency for holding future advisory votes to approve the compensation of the Company’s named executive officers. Abstentions and broker non-votes will not affect the outcome of the vote. For each of the proposals, holders of the Series H Preferred Stock and holders of the Common Stock shall be deemed to vote together as a single class. What is a “broker non-vote”? A “broker non-vote” occurs when a broker who holdsnominee holding shares for thea beneficial owner does not vote on a particular proposal because the brokernominee does not have discretionary voting authoritypower for that proposalparticular item and has not received instructions from the beneficial ownerowner. Brokerage firms have the authority under NYSE rules to cast votes on certain “routine” matters if they do not receive instructions from their customers. The ratification of the shares.appointment of EY as the Company’s independent registered public accounting firm is considered a “routine” matter for which brokerage firms may vote shares for which they did not receive instructions from beneficial owners. All other items on this year’s ballot are “non-routine” matters under the NYSE rules for which brokers may not vote absent voting instructions from the beneficial owner. Are stockholders entitled to appraisal rights in connection with any of the proposals? None of the proposals, if approved, entitle stockholders to appraisal rights under Maryland law or the Company’s Charter. What constitutes a “quorum”? The presence at the Annual Meeting, in person or represented by proxy, of stockholders entitled to cast a majority of all the votes entitled to be cast at the Annual Meeting constitutes a quorum. Abstentions and broker non-votes will be counted as present for the purpose of establishing a quorum. Will you incur expenses in soliciting proxies? We are soliciting the proxy on behalf of the Board, and we will pay all of the costs of preparing, assembling and mailing the proxy materials.soliciting these proxies. We have retainedengaged Broadridge Investor Communication Solutions, Inc. (“Broadridge”) to, aidamong other things, assist us in the solicitation ofdistributing proxy materials and soliciting proxies. We expect to pay Broadridge will receive a feeaggregate fees of approximately $186,000$27,500 to distribute and solicit proxies plus other fees and expenses for other services related to this proxy solicitation, services provided for us, which includes the reimbursement for certain costsincluding distributing proxy materials; disseminating brokers’ search cards; distributing proxy materials; operating online and out-of-pocket expenses incurred in connection with their services, alltelephone voting systems; and receiving of which will be paid by us. We will request banks, brokers, custodians, nominees, fiduciaries and other record holders to make available copies of this Proxy Statement to people on whose behalf they hold shares of Common Stock and to request authority for the exercise of proxies by the record holders on behalf of those people.executed proxies. In compliance with the regulations of the Securities and Exchange Commission (“SEC”),SEC, we will also reimburse such personsbrokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocketexpenses incurred by them in making availableto the extent they forward proxy and solicitation materials to the beneficial ownersour stockholders. Our directors and officers and employees of sharesaffiliates of our Common Stock.advisor, Benefit Street Partners L.L.C. (the “Advisor”), may also solicit proxies on our behalf in person, via the Internet, by telephone or by any other electronic means of communication we deem appropriate, for which they will not receive any additional compensation. Is this Proxy Statement the only way that proxies are being solicited? As the dateNo. In addition to our mailing proxy solicitation material, our directors and officers and employees of Broadridge and affiliates of the Annual Meeting approaches, certain stockholders whose votes have not yet been receivedAdvisor may receive aalso solicit proxies in person, via the Internet, by telephone call from a representativeor by any other electronic means of Broadridge. Votes that are obtained telephonically will be recorded in accordance with the procedures described below. The Board believes that these procedures are reasonably designed to ensure that both the identity of the stockholder casting the vote and the voting instructions of the stockholder are accurately determined.communication we deem appropriate.

In all cases where a telephonic proxy is solicited, the call is recorded and the Broadridge representative is required to confirm each stockholder’s full name, address and zip code, and to confirm that the stockholder has received the proxy materials. If the stockholder is a corporation or other entity, the Broadridge representative is required to confirm that the person is authorized to direct the voting of the shares. If the information solicited agrees with the information provided to Broadridge, then the Broadridge representative has the responsibility to explain the process, read the proposal listed on the proxy card and ask for the stockholder’s instructions on the proposal. Although the Broadridge representative is permitted to answer questions about the process, he or she is not permitted to recommend to the stockholder how to vote, other than to read any recommendation set forth in this Proxy Statement. Broadridge will record the stockholder’s instructions on the card. Within 72 hours, the stockholder will be sent a letter to confirm his or her vote and ask the stockholder to call Broadridge immediately if his or her instructions are not correctly reflected in the confirmation.

What does it mean if I receive more than one proxy card? card or Notice of Internet Availability of Proxy Materials? Some of your shares may be registered differently or held in a different account.account and/or you may hold shares of Common Stock and Preferred Stock. You should authorize a proxy to vote the shares in each of your accounts and all classes of securities held by mail, by telephone or via the Internet. If you mail proxy cards, please sign, date and return each proxy card to guarantee that all of your shares are voted. If you hold your shares in registered form and wish to combine your stockholder accounts in the future, you should call our Investor Relations department at (844) 785-4393. Combining accounts reduces excess printing and mailing costs, resulting in cost savings to us that benefit you as a stockholder. | | | | | | FRANKLIN BSP REALTY TRUST | | 5 | | 2023 PROXY STATEMENT |

What if I receive only one set of proxy materials although there are multiple stockholders at my address? The SEC has adopted a rule concerning the delivery of documents filed by us with the SEC, including proxy statements and annual reports. The rule allows us and brokers to send a single set of any annual report, proxy statement,materials, including proxy statement combined with a prospectus or information statementstatements and notices, to any household at which two or more stockholders reside if they share the same last name or we reasonably believe they are members of the same family. This procedure is referred to as “Householding.” This rule benefits both you and us. It reduces the volume of duplicate information received at your household and helps us reduce expenses. Each stockholder subject to Householding will continue to receive a separate proxy card or voting instruction card. We will promptly deliver, upon written or oral request, a separate copy of our 2019 Annual Report2022 annual report or this Proxy Statement,proxy statement, as applicable, to a stockholder at a shared address to which a single copy was previously delivered. If your household received a single set of disclosure documents for this year, but you would prefer to receive your own copy, you may direct requests for separate copies by calling our Investor Relations department at (844) 785-4393(212) 588-6761 or by mailing a request to Benefit Street PartnersFranklin BSP Realty Trust, Inc., 9 West 57thStreet,1345 Avenue of the Americas, Suite 4920,32A, New York, New York 10019,10105, Attention: Investor Relations. Likewise, if your household currently receives multiple sets of notices or disclosure documents and you would like to receive one set, please contact us. Where can I find more information? Whom should I callYou may access, read and print copies of the proxy materials for additional information about voting by proxy or authorizing a proxy by telephone or Internet to vote my shares?

Please call Broadridge, our proxy solicitor, at (855) 601-2252.

Whom should I call with other questions?

If you have additional questions aboutthis year’s Annual Meeting, including this Proxy Statement, form of proxy card, and annual report to stockholders, at the following website: www.proxyvote.com/FBRT.

You can request a paper or the Annual Meeting or would like additional copieselectronic copy of this Proxy Statement, or our 2019 Annual Report or any documents relating to any of our future stockholder meetings, please contact: Benefit Street Partners Realty Trust, Inc. 9 West 57thStreet, Suite 4920, New York, New York 10019, Attention: Investor Relations, Telephone: (844) 785-4393, E-mail:info@bsprealtytrust.com,website:www.bsprealtytrust.com. How do I submit a stockholder proposal for next year’s annual meeting, and what is the deadline for submitting a proposal?

In order for a stockholder proposal to be properly submitted for presentation at our 2021 annual meeting and included in our proxy materials, we must receive noticefree of the proposal on or before December 4, 2020. All such proposals must comply with Rule 14a-8 under the Exchange Act.

In order for a stockholder proposal to be properly submitted for presentation at our 2021 annual meeting, but not for inclusion in our proxy materials, we must receive notice, via registered, certified or express mail, not earlier than November 4, 2020, and not later than 5:00 p.m., Eastern Time, on December 4, 2020. All proposals must contain the information specified in, and otherwise comply with, our bylaws.

All proposals should be sent to 9 West 57thStreet, Suite 4920, New York, New York 10019, Attention: Investor Relations. For additional information, see “Stockholder Proposals for the 2021 Annual Meeting.”

UNLESS SPECIFIED OTHERWISE, THE PROXIES WILL BE VOTED “FOR” (I) THE ELECTION OF THE FIVE NOMINEES NAMED IN THIS PROXY STATEMENT TO SERVE AS DIRECTORS OF THE COMPANY FOR A TERM OF ONE YEAR UNTIL THE COMPANY’S 2021 ANNUAL MEETING OF STOCKHOLDERS AND UNTIL THEIR SUCCESSORS ARE DULY ELECTED AND QUALIFY; AND (II) THE RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE YEAR ENDING DECEMBER 31, 2020. IN THE DISCRETION OF THE PROXY HOLDERS, THE PROXIES WILL ALSO BE VOTED “FOR” OR “AGAINST” SUCH OTHER MATTERS AS MAY PROPERLY COME BEFORE THE ANNUAL MEETING. MANAGEMENT IS NOT AWARE OF ANY OTHER MATTERS TO BE PRESENTED FOR ACTION AT THE ANNUAL MEETING.charge:

via Internet, at www.proxyvote.com/FBRT; | • | | 5via telephone, at (800) 579-1639; or |

| • | | via e-mail, at sendmaterial@proxyvote.com. |

We also file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy any reports, statements or other information we file with the SEC on the web site maintained by the SEC at www.sec.gov. | | | | | | FRANKLIN BSP REALTY TRUST | | 6 | | 2023 PROXY STATEMENT |

PROPOSAL NO. 1 — ELECTION OF DIRECTORSInvestor Stewardship Group Principles

FBRT’s practices align with the Investor Stewardship Group’s (“ISG”) corporate governance framework for U.S. – listed companies, as described below. | | | | ISG Principles | | FBRT Practice | | | Principle 1: Boards are accountable to stockholders | | All directors stand for election annually Majority voting standard in uncontested director elections, with mandatory resignation policy Stockholders are entitled to recommend director candidates to the Nominating and Corporate Governance Committee | | | Principle 2: Stockholders should be entitled to voting rights in proportion to their economic interest | | No dual-class share structure One vote per share structure | | | Principle 3: Boards should be responsive to stockholders and be proactive in order to understand their perspectives | | Regular stockholder engagement on business, governance, and ESG matters Added a Management Say on Pay proposal to the ballot in 2023 based on stockholder feedback Added a qualified director from an underrepresented community to our Board of Directors In 2022, amended bylaws to allow stockholders to amend the bylaws, and in 2023, proposed charter amendment to eliminate the supermajority requirement to amend certain provisions of the charter Board considers annual voting results and ongoing investor engagement feedback in setting company policies and strategy | | | Principle 4: Boards should have a strong, independent leadership structure | | Lead Independent Director with clearly defined responsibilities All Committees are chaired by Independent Directors and are 100% independent Independent Director-only executive session at every regular Board meeting |

| | | | | | FRANKLIN BSP REALTY TRUST | | 7 | | 2023 PROXY STATEMENT |

| | | | | Principle 5: Boards should adopt structures and practices that enhance their effectiveness | | Annual Board and Committee evaluation process Directors possess deep and diverse set of skills and experience relevant to oversight of our strategy Board composition reflects broad range of relevant perspectives, skills and knowledge including gender, racial and ethnic diversity: 43% of our Board nominees are gender or racially diverse 86% of the Board nominees are independent In 2022, each director attended at least 75% of the meetings of the Board and the Committees on which he or she served | | | Principle 6: Boards should develop management incentive structures that are aligned with the long-term strategy of the company | | Management Say on Pay included on the ballot The Compensation Committee oversees and reports to the Board on the assessment and mitigation of risks associated with the Company’s and the Advisor’s compensation policies and practices and incentive compensation arrangements Equity awards granted to executive officers subject to three-year vesting periods Adopted stock ownership requirements for executive officers Advisor’s incentive fee tied directly to stockholder returns |

| | | | | | FRANKLIN BSP REALTY TRUST | | 8 | | 2023 PROXY STATEMENT |

| | | | | | PROPOSAL NO. 1—ELECTION OF DIRECTORS | | | | | |

The Board ultimately is responsible for the management and control of our business and operations. The Board, including our independent directors, is responsible for monitoring and supervising the performance of our day-to-day operations by our advisor, Benefit Street Partners L.L.C. (the “Advisor”).Advisor. Directors are elected annually by our stockholders, and there is no limit on the number of times a director may be elected to office. Each director serves for a term of one year until the next annual meeting of stockholders or (if longer) until his or her successor is duly elected and qualifies. The Company’s charter and bylaws provide that the number of directors may be fixed by a resolution of the Board; provided, however, that the number of directors shall never be less than three. The number of directors on the Board is currently fixed at five. The Board has proposedeight, although the following nominees for electionBoard’s size will be fixed at seven effective as directors, each to serve for a term of one year, until our 2021 annual meeting of stockholders and until his or her successor is duly elected and qualifies: Richard J. Byrne, Jamie Handwerker, Peter J. McDonough, Buford H. Ortale and Elizabeth K. Tuppeny. Each nominee currently serves as a director of the Company.

Annual Meeting. The proxy holder named on the proxy card intends to vote “FOR” the election of each of the fiveseven nominees. If you do not wish your shares to be voted “FOR” particular nominees, please identify the exceptions in the designated space provided on the proxy card or, if you are authorizing a proxy to vote your shares by telephone or the Internet, follow the instructions provided when you authorize a proxy. Directors willUnder our bylaws, a nominee for director in an uncontested election shall be elected byto our Board if the affirmative vote ofvotes cast for such nominee’s election exceed the holders of a majority of all shares of our stock who are present in person or by proxy at the Annual Meeting, provided that a quorum is present. Any shares not voted (whether by abstention, broker non-vote or otherwise) have the same effect as votes cast against each director. such nominee’s election. Each share of our voting stock may be voted for as many individuals as there are directors to be elected and for whose election the share is entitled to be voted. For purposes of the election of directors, abstentions and broker non-votes will count toward the presence of a quorum but are not considered to be votes “cast” and will have no effect on the election of our directors. We know of no reason why any nominee would be unable to serve if elected. If, at the time of the Annual Meeting, one or more of the nominees should become unable to serve, shares represented by proxies will be voted for the remaining nominees and for any substitute nominee or nominees designated by the Board. No proxy will be voted for a greater number of persons than the number of nominees described in this Proxy Statement.proxy statement. Nominees The table set forth below lists the name and age of each nominee as of the date of this Proxy Statement and the position and office that each nominee currently holds with the Company. Each is currently a director of the Company who was elected by the Company’s stockholders at the 2022 annual meeting, with the exception of Joe Dumars, who joined the Board on January 1, 2023 and is standing for election for the first time. Name Age Position

Name | | | | | Name* | | Age | | Position | Richard J. Byrne | | 5962 | | Chairman of the Board of Directors and Chief Executive Officer and President | Jamie HandwerkerPat Augustine | | 60 | | Director | Joe Dumars | | 59 | | Director | Jamie Handwerker | | 62 | | Director, Compensation Committee Chair | Peter J. McDonough | | 6164 | | Director, Nominating and Corporate Governance Committee Chair | Buford H. Ortale | | 5861 | | Director, Audit Committee Chair | Elizabeth K. Tuppeny | | 5962 | | Lead Independent Director |

As noted above, the Board appointed Mr. Dumars as a director effective January 1, 2023, based on the recommendation of the Nominating and Corporate Governance Committee. Prior to recommending Mr. Dumars, the Nominating and Corporate Governance Committee developed and considered a list of potential nominees. The candidate list comprised suggestions from other directors. Mr. Byrne’s suggestions included Mr. Dumars. In evaluating Ms. Handwerker’s nomination, the Nominating and Corporate Governance Committee and the Board considered that Ms. Handwerker received approximately 80% of the votes cast at our 2022 annual meeting of stockholders, which was below the average of our other directors and below the support she has historically received. We believe this difference was attributable to Ms. Handwerker serving as the chair of the Compensation Committee and the Company’s decision not to provide for a “say on pay” vote at the 2022 Annual Meeting. The Company did not provide for a “say on pay” vote last year because there was no compensation of named executive officers in 2021 and thus nothing for stockholders to vote on. The Company does not believe this will be an issue this year as the Company did pay executive compensation in 2022 and as a result is including a “say on pay” vote at the Annual Meeting (Proposal 4).

| | | | | | FRANKLIN BSP REALTY TRUST | | 9 | | 2023 PROXY STATEMENT |

Business Experience of Nominees The name, principal occupation for the last five years, selected biographical information and the period of service as our director of each of the nominees are set forth below. Full biographical data is available on our website at www.fbrtreit.com under the “Governance” tab. Richard J. Byrne

Richard J. Byrne has served as Chairman of the Board of Directors, Chief Executive Officer and President of the Company since September 2016. Mr. Byrne has served as the President of the Advisor since 2013. He has also served as Chairman of the Board of Directors, Chief Executive Officer and President of the Business Development Corporation of America since November 2016 and Broadtree Residential, Inc. since February 2020. Prior to joining the Advisor, Mr. Byrne was Chief Executive Officer of Deutsche Bank Securities, Inc. He was also the Co-Head of Global Capital Markets at Deutsche Bank. Before joining Deutsche Bank, Mr. Byrne was Global Co-Head of the Leveraged Finance Group and Global Head of Credit Research at Merrill Lynch & Co. He was also a perennially top-ranked credit analyst. Mr. Byrne earned an M.B.A. from the Kellogg School of Management at Northwestern University and a B.A. from Binghamton University. Mr. Byrne is a member of the Boards of Directors of MFA Financial, Inc. (NYSE: MFA), Wynn Resorts, Limited (NASDAQ: WYNN) and New York Road Runners. We believe that Mr. Byrne’s current and prior experience as a director and Chief Executive Officer of the Company, and his significant investment banking experience in real estate make him well qualified to serve as a member of our Board.

| | | | |

| | 6Richard Byrne Chairman of the Board and CEO Director Since: 2016 Age: 62 | | Committees None |

| | | | | Relevant Experience 2013-Present: Benefit Street Partners • President • In his role as President, he serves as CEO and Chairman of: Franklin BSP Realty Trust., Franklin BSP Lending Corp., and Franklin BSP Capital Corp. 1999-2013: Deutsche Bank • 2008-2013: Chief Executive Officer, Deutsche Bank Securities, Inc. • 2006-2013: Global Co-Head of Capital Markets at Deutsche Bank • 2001-2010: Member of the Global Banking Executive Committee and the Global Markets Executive Committee 1985-1999: Merrill Lynch & Co. • Global Co-Head of the Leveraged Finance Group and Global Head of Credit Research | | Qualifications: Mr. Byrne’s current and prior experience as a director and Chief Executive Officer of the Company, and his significant investment banking experience in real estate finance make him well-qualified to serve as a member of our Board. Current Public Company Boards: Wynn Resorts, Ltd. Affiliated, Non-Listed BDC Boards*: Franklin BSP Lending Corp. Franklin BSP Capital Corp. Previous Public Company Boards: MFA Financial, Inc. * Affiliated non-traded Business Development Companies (“BDCs”) regulated under the Investment Company Act of 1940 that are managed by the Advisor. |

| | | | |

| | Pat Augustine Independent Director Director Since: 2021 Age: 60 | | Committees Compensation, Nominating and Corporate Governance |

| | | | | Relevant Experience 2011-2019: Meridian Enterprises • Founder • Built, owned, and operated Planet Fitness franchises before selling to a private equity firm 2009-2011: Swiss RE Insurance Asset Management • Head of Structured Product and Credit Portfolio Management 1996-2007: NationsBank (predecessor to Bank of America) • Head of sales, trading, and research for structured products 1985-1996: Salomon Brothers • Mortgage-backed securities trader | | Qualifications: Mr. Augustine’s experience founding a company and his tenure in the financial industry, specifically his experience in both residential and commercial real estate, make him a valuable asset to the Board. Previous Public Company Boards: Capstead Mortgage Corporation |

| | | | | | FRANKLIN BSP REALTY TRUST | | 10 | | 2023 PROXY STATEMENT |

Jamie Handwerker

Jamie Handwerker has served as an independent director of the Company since September 2016. Ms. Handwerker is a partner of KSH Capital, providing real estate entrepreneurs with capital and expertise to seed or grow their platform. Prior to joining KSH, Ms. Handwerker was a Senior Vice President and Principal of Cramer Rosenthal McGlynn (CRM) LLC, a New York-based asset management firm, which serves as investment adviser to institutions, as well as individual and family trusts. Ms. Handwerker was the portfolio manager for the CRM Windridge Partners hedge funds since she founded the Funds in June 2000. The funds were long/short US equity hedge funds, focused on real estate and consumer companies, generating absolute returns. Prior to joining CRM in April 2002, Ms. Handwerker managed Windridge Partners, L.P, as a Managing Director and Portfolio Manager with ING Furman Selz Asset Management LLC, a New York based holding company operating as a wholly-owned subsidiary of the Dutch financial conglomerate, ING Group. Ms. Handwerker previously was a Managing Director and Senior Equity Research Analyst (Sell-Side) from 1994 to 2000 at the international corporate and investment bank ING Barings and its predecessor, Furman Selz, LLC where she exclusively focused on real estate companies, including the REIT industry. She received a B.A. in Economics from the University of Pennsylvania. Ms. Handwerker serves on the Board of Trustees of Lexington Realty Trust. She also is a member of the University of Pennsylvania School of Arts & Sciences Board of Overseers and is the Founder and Chairperson of Penn Arts & Sciences Professional Women’s Alliance, as well as being involved in other charitable endeavors. We believe Ms. Handwerker’s extensive experience in real estate venture capital, asset management and portfolio management described above make her well qualified to serve as a member of our Board.

Peter J. McDonough

Peter J. McDonough has served as an independent director of the Company since April 2016. Mr. McDonough most recently served as President, Chief Marketing and Innovation Officer for Diageo North America, where he led the brand marketing and innovation group of a $5+ billion business unit from 2009 to 2015. He served in this role at the world’s largest premium drinks company after being promoted from his earlier position in the company as General Manager; North American Innovation which he held from 2006 to 2009. In this role, Mr. McDonough transformed and built the marketing and product development organization of North America’s leading portfolio of premium and luxury spirit brands with new capabilities, a more focused strategic outlook and business plans that accelerated growth and positioned Diageo as the industry leader in new product innovation. Prior to joining Diageo, Mr. McDonough was the Vice President, European Marketing at The Procter & Gamble Company from 2004 to 2006, where he led the Gillette Division’s Duracell Battery and Braun Appliance Business Units with annual sales of more than $1.4 billion. From 2002 to 2004, Mr. McDonough was a university lecturer and management consultant at the University of Canterbury, Graduate School of Commerce in Christchurch, New Zealand. Prior to this academic post he served as Vice President of Marketing for Gillette’s flagship U.S. and Canadian Blade Razor & Grooming Products division with annual sales of $1.3 billion. In this role he directed the North American market launch of leading brands like Mach3 Turbo for men, Venus Razors for women and several other leading grooming product brands. Earlier in his career, Mr. McDonough served as Director of North American Marketing at Black & Decker where he was involved in launching the DeWalt Power Tool Company. Mr. McDonough has served on several boards of directors and advisory committees since 2010, including The Ad Council of America, Effie Worldwide, Inc., The Splash Beverage Group and Ignition One Interactive. Mr. McDonough received a B.A. from Cornell University and a Masters of Business Administration from the Wharton School of Business. We believe Mr. McDonough’s extensive experience as an executive officer and/or director of the companies described above and his significant business accomplishments make him well qualified to serve as a member of our Board.

Buford H. Ortale

Buford H. Ortale has served as an independent director of the Company since September 2016. Mr. Ortale is a private equity investor based in Nashville, Tennessee. He is a partner in NTR, a private equity firm focused on the energy space as well as a partner in ACM, the external manager of a residential mortgage REIT with over $8 billion in assets. Mr. Ortale began his career with Merrill Lynch’s Merchant Banking Group in New York in 1987. He was subsequently a founder and managing director of NationsBanc’s (Bank of America) High Yield Bond Group. In 1996 he formed Sewanee Ventures, a private equity investment vehicle that he still manages today. Mr. Ortale’s activities have included investments in startup venture backed companies, LBO’s, real estate development, and real estate acquisition. He is currently a board advisor to Western Express (a privately owned $700 million trucking company) and a board member of Intrensic (a police bodycam and digital evidence management company) and Broadtree Rresidential, Inc. He received his BA from Sewanee: The University of the South and his MBA from Vanderbilt University. We believe Mr. Ortale’s extensive experience as a private equity investor and banker described above make him well qualified to serve as a member of our Board of Directors.

Elizabeth K. Tuppeny

Elizabeth K. Tuppeny has served as an independent director of the Company since January 2013. Ms. Tuppeny has also served as an independent director of American Realty Capital New York City REIT, Inc. (“NYCR”) since March 2014 and in December 2014, she was appointed lead independent director of NYCR. Ms. Tuppeny has also served as an independent director of Healthcare Trust, Inc. (“HTI”) since January 2013. Ms. Tuppeny also served as an independent director of American Realty Capital Trust IV, Inc. (“ARCT IV”) from May 2012 until the close of ARCT IV’s merger with American Realty Capital Properties, Inc. (“ARCP”) in January 2014, after which point Ms. Tuppeny was no longer associated with ARCT IV as an independent director nor affiliated with ARCT IV in any manner. Ms. Tuppeny has been the chief executive officer and founder of Domus, Inc. (“Domus”), a full-service marketing communications agency, since 1993. Domus’ largest client is Merck & Co., and Ms. Tuppeny advises Merck & Co. with respect to communications related to their healthcare-related real estate acquisitions. Ms. Tuppeny has 30 years of experience in the branding and advertising industries, with a focus on Fortune 50 companies. Ms. Tuppeny also founded EKT Development, LLC to pursue entertainment projects in publishing, feature film and education video games. Prior to founding Domus, Ms. Tuppeny was executive vice president, business development at Earle Palmer Brown from 1992 to 1993. From 1984 to 1993, Ms. Tuppeny worked at Weightman Advertising, where she became senior vice president. From 1982 to 1984, Ms. Tuppeny was an account executive at The Marketing Group. Ms. Tuppeny served on the board of directors and executive committee of the Philadelphia Industrial Development Council (“PIDC”) for three-plus years where she helped to plan and implement real estate transactions that helped to attract jobs to Philadelphia. As a board member of the PIDC, Ms. Tuppeny was responsible for evaluating and approving commercial and residential real estate business development applications for financing and tax abatement for for-profit and non-profit companies. During her tenure on the PIDC, Ms. Tuppeny approved over 500 real estate development applications including the funding for the Wistar Institute’s biotech and cancer research facility, the Thomas Jefferson University Hospital, a 1.2 million square foot distribution center for Teva Pharmaceuticals Industries Ltd., the Hospital of the University of Pennsylvania/Children’s Hospital of Philadelphia expansion and the Philadelphia State Hospital at Byberry. Ms. Tuppeny has served on the boards of directors and advisory committees for the Arthur Ashe Foundation, Avenue of the Arts, Drexel Medical School, Philadelphia Hospitality Cabinet, Pennsylvania Commission for Women, Penn Relays and the Police Athletic League. Ms. Tuppeny was the recipient of the national Stevie Award as the nation’s top woman entrepreneur in 2004 and was named as a “Top Woman in Philadelphia Business” in 1996, one of the “Top 50 Women in Pennsylvania” in 2004 and as the “Businessperson of the Year” in 2003 by the Greater Philadelphia Chamber of Commerce. Ms. Tuppeny has taught at New York University, University of Pennsylvania and Temple University, and received her undergraduate degree from the University of Pennsylvania, Annenberg School of Communications. We believe that Ms. Tuppeny’s prior and current experience as an independent director of the companies described above, as chief executive officer and founder of Domus, and in evaluating healthcare-related real estate business development applications, make her well qualified to serve on our Board.

| | | | |

| | Joe Dumars Independent Director Director Since: 2023 Age: 59 | | Committees Audit, Nominating and Corporate Governance |

| | | | | Relevant Experience 2022-Present: National Basketball Association (“NBA”) • EVP and Head of Basketball Operations 2020-2022: Sacramento Kings NBA franchise • Chief Strategy Officer 2017-2019: Independent Sports & Entertainment, LLC • President of Basketball Division 1999-2014: Detroit Pistons NBA Franchise • President of Basketball Operations 1985-1999: Detroit Pistons • Professional basketball player • Six-time NBA All-Star | | Qualifications: Mr. Dumars is an experienced executive, owner, and operator of multiple businesses with a track record of accomplishments based on individual contribution, leadership and team building. Mr. Dumars’ operational expertise and experience in corporate strategy development and human capital management make him well qualified to serve as a member of our Board. |

| | | | |

| | Jamie Handwerker Independent Director Director Since: 2016 Age: 62 | | Committees Audit, Compensation (Chair), Nominating and Corporate

Governance |

| | | | | Relevant Experience 2016 - Present: KSH Capital • Partner • Real estate investment firm established to provide entrepreneurs with capital and expertise to grow their platform 2002 - 2016 Cramer Rosenthal McGlynn (CRM) LLC • Senior Vice President, Principle, and Portfolio Manager for Windridge Partners 2000 - 2002: ING Furman Selz Asset Management • Managing Director and Portfolio Manager • Launched Windridge Partners, a long/short US equity hedge fund focused on real estate and consumer companies 1994-2000: ING Barings and Furman Selz, LLC (predecessor of ING Barings) • Managing Director and Senior Equity Research Analyst (Sell-Side) • Exclusively focused on real estate companies, including the REIT industry | | Qualifications: Ms. Handwerker’s extensive experience in real estate, asset management, and portfolio management make her well qualified to serve as a member of our Board. Current Public Company Boards: Lexington Realty Trust |

| | | | | | FRANKLIN BSP REALTY TRUST | | 11 | | 2023 PROXY STATEMENT |

| | | | |

| | Peter J. McDonough Independent Director Director Since: 2016 Age: 64 | | Committees Audit, Compensation, Nominating

and Corporate Governance |

| | | | | Relevant Experience 2018-2022: Trait Biosciences • Chief Executive Officer • Trait Biosciences is a biotechnology research organization developing Intellectual Property associated with the formulation of CBD Health & Wellness Products. 2006-2015: Diageo • President, Chief Marketing and Innovation Officer 2004-2006: Procter & Gamble • Vice President of European Marketing overseeing the brand marketing function for Duracell Batteries and Braun Appliances 2002-2004: University of Canterbury, Graduate School of Commerce • University lecturer and management consultant 1994-2002: Gillette • Vice President of North American Marketing • Launched industry leading brands such as Mach3 Turbo and Venus Razors. 1990-1994: Black & Decker • Director of North American Marketing • Launched the DeWalt Power Tool Company. | | Qualifications: Mr. McDonough brings innovative thinking to transform business performance from diverse experiences leading global organizations in industries such as Biotechnology, Personal Care Products, Consumer Appliances, Power Tools and Beverage Alcohol. In his diverse career, Peter has served as a senior leader in seven different industries, gaining cultural insights from global professional experiences. We believe Mr. McDonough’s extensive experience as an executive officer and/or director and his significant business accomplishments make him well qualified to serve as a member of our Board. Current Public Company Boards: The Splash Beverage Group |

| | | | | | FRANKLIN BSP REALTY TRUST | | 12 | | 2023 PROXY STATEMENT |

| | | | |

| | Buford H. Ortale Independent Director Director Since: 2016 Age: 61 | | Committees Audit (Chair), Compensation, Nominating and Corporate

Governance |

| | | | | Relevant Experience 2018-Present: NTR • Partner • NTR is a private equity firm focused on the energy space 2010-Present: Armour Capital Management, LP • Partner • Armour is the external manager of a residential mortgage REIT with over $8 billion in assets 1996-Present: Sewanee Ventures • Founder and Manager • Sewanee Ventures is a private investment vehicle focused on investments in real estate, venture capital, and private equity 1993-1996: NationsBanc (Bank of America) • Founder and Managing Director of the High Yield Bond Group 1987-1991: Merrill Lynch Merchant Banking Group • Vice President of High Yield Sales | | Qualifications: Mr. Ortale’s expertise include investments in startup venture backed companies, LBO’s, real estate development and acquisitions and private debt. We believe Mr. Ortale’s extensive experience as a private equity investor and banker make him well qualified to serve as a member of our Board of Directors. Current Public Company Boards: Waitr Holdings, Inc. |

| | | | |

| | Elizabeth K. Tuppeny Lead Independent Director Director Since: 2013 Age: 62 | | Committees Audit, Compensation, Nominating

and Corporate Governance |

| | | | | Relevant Experience 1993-Present: Domus, Inc. • Founder and Chef Executive Officer • Domus works at the C-Suite level with clients such as Chevron; Citibank; ConAgra; Diageo; DuPont; Epson; Mattel; Merck; Merrill Lynch; Procter & Gamble; Ralph Lauren and Westinghouse 1992-1993: Earle Palmer Brown • Executive Vice President of Business Development 1984-1992: Weightman Advertising • Senior Vice President | | Qualifications: Ms. Tuppeny has 30 years of experience in the branding and advertising industries, with a focus on Fortune 50 companies. We believe that Ms. Tuppeny’s experience as a Chief Executive Officer and an independent director of multiple companies, as well as her track record in evaluating real estate business development applications, make her well qualified to serve on our Board. Current Public Company Boards: Healthcare Trust, Inc New York City REIT, Inc Previous Public Company Boards: American Realty Capital Trust IV |

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE ELECTION OF RICHARD J. BYRNE, JAMIE HANDWERKER, PETER J. MCDONOUGH, BUFORD H. ORTALE AND ELIZABETH K. TUPPENY AS MEMBERSEACH OF THE BOARD OF DIRECTORS,DIRECTOR NOMINEES NAMED ABOVE, EACH TO SERVE UNTIL THE 20212024 ANNUAL MEETING OF STOCKHOLDERS AND UNTIL THEIR SUCCESSORS ARE DULY ELECTED AND QUALIFY.

| | | | | | FRANKLIN BSP REALTY TRUST | | 13 | | 2023 PROXY STATEMENT |

The following table sets forth information regarding fees earned by our non-management directors during the fiscal year ended December 31, 2022. Mr. Byrne, our Chief Executive Officer, received no compensation for serving as a director. Mr. Dumars was appointed to the Board effective January 1, 2023 and therefore received no compensation in 2022. | | | | | | | | | | | | | | | | Name | | Fees Paid in Cash | | Stock Awards(1) | | Total | | | | | Elizabeth K. Tuppeny | | | $ | 175,000 | | | | $ | 50,000 | | | | $ | 225,000 | | | | | | Buford H. Ortale | | | | 162,500 | | | | | 50,000 | | | | | 212,500 | | | | | | Peter J. McDonough | | | | 162,500 | | | | | 50,000 | | | | | 212,500 | | | | | | Jamie Handwerker | | | | 162,500 | | | | | 50,000 | | | | | 212,500 | | | | | | Pat Augustine | | | | 135,000 | | | | | 83,200 | (2) | | | | 218,200 | | | | | | Gary Keiser | | | | 135,000 | | | | | 83,200 | (2) | | | | 218,200 | | | | | | Michelle P. Goolsby(3) | | | | 60,000 | | | | | 33,200 | (2) | | | | 93,200 | |

| (1) | All directors except Ms. Goolsby received an annual grant of restricted stock under the Company’s Amended and Restated Employee and Director Incentive Restricted Share Plan. For 2022, the grant date fair value of the shares of restricted stock granted to the independent directors under the annual grant was $50,000, or $14.33 per share, determined as of the grant date on June 29, 2022 and in accordance with the ASC Stock Compensation topic. As of December 31, 2022, each of the directors included in the table above (except for Ms. Goolsby) held 3,489 unvested shares of restricted stock, all from the 2022 annual grant. |

| (2) | Messrs. Augustine and Keiser and Ms. Goolsby joined the Board in October 2021. In February 2022 the Compensation Committee approved a restricted stock grant of 2,403 shares with a grant-date fair value of $33,200 to each of Messrs. Augustine and Keiser and Ms. Goolsby, which represented a pro-rated amount of the prior year’s $50,000 annual director stock grant based on their time of service on the Board. The grants vested on June 3, 2022. |

| (3) | Ms. Goolsby’s term as a director ended at the Annual Meeting of Stockholders on June 29, 2022. |

In the summer of 2022, the Compensation Committee undertook an analysis of the Company’s compensation program for non-management directors, and with the advice of the Committee’s compensation consultant, Pearl Meyer, the Compensation Committee approved certain changes to the program to better align with market practices. The Compensation Committee approved an overall increase of $35,000 in annual base compensation for the independent directors, taking effect starting in the second half of 2022. The following tables sets forth the terms of our current non-management director compensation program: | | | | | Annual Director Cash Retainer | | $110,000 | | | Committee Fees (Cash) | | $20,000 for the chairs of the Audit Committee, Nominating and Corporate Governance Committee and Compensation Committee; and $10,000 for each member of a committee who is not serving as a chair. | | | Lead Independent Director Supplemental Fee (Cash) | | $30,000 | | | Annual Equity Award | | On the date of the annual meeting of stockholders, each non-management director receives an annual grant of $85,000 in restricted shares of Common Stock based on the closing price of our Common Stock on the date of grant. The restricted shares vest on the anniversary of the grant date. | | | Expense Reimbursement | | All non-management directors also receive reimbursement of reasonable out of pocket expenses incurred in connection with attendance at meetings of our Board of Directors. |

| | | | | | FRANKLIN BSP REALTY TRUST | | 14 | | 2023 PROXY STATEMENT |

| | | | | | BOARD OF DIRECTORS AND COMMITTEES | | | | | |

Information About the Board of Directors and its Committees The Board ultimately is responsible for the management and control of our business and operations. We have no employees and have retained the Advisor to manage our day-to-day operations. The Advisor isa wholly-owned subsidiary of Franklin Resources, Inc., which, together with its various subsidiaries, operates as Franklin Templeton.Templeton. Our Board currently has eight members and is comprised of Messrs. Byrne, Augustine, Dumars, McDonough, Keiser, and Ortale and Mses. Handwerker and Tuppeny. Mr. Keiser is not standing for re-election and his term will expire at the Annual Meeting. The Nominating and Corporate Governance Committee of the Board considers and makes recommendations to the Board concerning the appropriate size and needs of the Board and considers and recommends to the Board candidates to fill vacancies on the Board. The Board held a total of seventhirteen meetings during the fiscal year ended December 31, 2019. All directors2022. Each director attended at least 75% of the meetings of the Board and nominees attended all of these meetings.the Board committees on which he or she served during 2022. The Board does not have a formal policy relating to director attendance at our annual meetings of stockholders. FourSix of our seven directors who were then on the Board attended the 20192022 annual meeting of stockholders. The Board currently has three standing committees: the Audit Committee, the Nominating and Corporate Governance Committee and the Compensation Committee, the members of which are all independent directors. The current written charters for each of the standing committees, as well as our Corporate Governance Guidelines, Code of Ethics and certain other corporate governance information are available on our website, www.fbrtreit.com, under the “Governance Documents” tab by selecting “Governance.” How Directors are Selected, Elected and Evaluated The Nominating and Corporate Governance Committee is responsible for reviewing, on an annual basis, the requisite skills and characteristics of individual Board members, as well as the organization, function and composition of the Board as a whole, in the context of the needs of the Company. The Nominating and Corporate Governance Committee reviews all nominees for director in accordance with criteria established by the Nominating and Corporate Governance Committee and the requirements and qualifications contained in the Company’s Corporate Governance Guidelines and will recommend that the Board nominate or elect those nominees whose attributes it believes would be most beneficial to the Company. The reviews involve an assessment of the personal qualities and characteristics, accomplishments and business reputation of each nominee. The Nominating and Corporate Governance Committee may consider such criteria as the committee shall deem appropriate, which may include, without limitation: personal and professional integrity, ethics and values; experience in corporate management, such as serving as an officer or former officer of a publicly held company; commercial real estate and finance experience; experience as a board member of another publicly held company; diversity of both background and experience, including diversity of gender, race, ethnicity, religion, nationality, disability, sexual orientation, or cultural background; practical and mature business judgment, including ability to make independent analytical inquiries; the nature of and time involved in a director’s service on other boards or committees; NYSE rules applicable to directors, including rules regarding independence, and | | | | | | FRANKLIN BSP REALTY TRUST | | 15 | | 2023 PROXY STATEMENT |

with respect to any person already serving as a director, the director’s past attendance at meetings and participation and contribution to the activities of the Board. The Nominating and Corporate Governance Committee identifies potential nominees by seeking input from fellow directors, executive officers, professional recruitment firms and stockholders and stakeholders. The Nominating and Corporate Governance Committee’s evaluation process does not vary based on whether a candidate is recommended by a stockholder, although in addition to taking into consideration the needs of the Board and the qualifications of the candidate, the committee may also consider the number of shares held by the recommending stockholder and the length of time that such shares have been held by such stockholder. The Board will consider candidates nominated by stockholders provided that the stockholder submitting a nomination has approvedcomplied with procedures set forth in the bylaws. See “Stockholder Proposals for the 2024 Annual Meeting” for additional information regarding stockholder nominations of director candidates. The Board believes that diversity is an important attribute of the members who comprise our Board and organizedthat the members should represent an auditarray of backgrounds and experiences, including racial, ethnic and gender diversity. The overall diversity of the Board is a significant consideration in the nomination process as well as our annual evaluation process of board effectiveness and composition with our Nominating and Corporate Governance Committee. As a result of a comprehensive Board skills and member composition exercise undertaken by the Nominating and Corporate Governance Committee in 2022, the Board has improved the diversity of its membership. Twenty-nine percent of our Board nominees identify as diverse in terms of gender identity, and 14% of our Board nominees identify as diverse in terms of race, bringing overall diversity of gender and racial diversity to 43%. We are pleased with the progress we have made on diversity and our Board and Nominating and Corporate Governance Committee continue to prioritize diversity and thoroughly integrate diversity into discussions on Board composition. Director Independence Under our Corporate Governance Guidelines and NYSE rules, a majority of our directors must be “independent.” A director is not independent unless the Board affirmatively determines that he or she does not have a “material relationship” with us and the director must meet the bright-line test for independence set forth by the NYSE rules. A relationship with the Advisor or an affiliate thereof (other than service as an independent director or trustee for another company managed by the Advisor) is treated as a relationship with the Company. Our Corporate Governance Guidelines also require all members of the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee to be “independent” directors. Based upon its review, the Board has affirmatively determined that each of Messrs. Augustine, Dumars, Keiser, McDonough and Ortale, and each of Mses. Handwerker and Tuppeny is independent under all applicable criteria for independence set forth in the listing standards of the NYSE, including with respect to committee service. In making its independence determinations, the Board considered and a nominatingreviewed all information known to it, including information identified through directors’ questionnaires. There are no familial relationships between any of our directors and corporate governance committee.executive officers. | | | | | | FRANKLIN BSP REALTY TRUST | | 16 | | 2023 PROXY STATEMENT |

Director Skills Effective as of the Annual Meeting, the Board will consist of seven directors. As described above, the Nominating and Corporate Governance Committee evaluates all director nominees in accordance with the criteria and qualifications contained in the committee’s charter as well as the Corporate Governance Guidelines. The Company does not currently haveis confident that its director nominees are well qualified and experienced, collectively possessing a compensation committee. The independent directors carry outstrong mix of expertise to oversee the responsibilities typically associated with compensation committees.Company’s strategy and generate long-term value for stockholders. Listed below are core skills and experiences valuable for our Board to possess: Skills Distribution | | | | | | | |

| | CEO/Executive Management Experience: Directors who possess experience in leading their organizations, providing practical experience to the Board into navigating complex issues and making strategic decisions. | |

|

| | Strategy Development and Implementation Experience: Directors with expertise in developing and overseeing the implementation of an organization’s long-term strategy, as well as navigating any hurdles or unforeseen circumstances. | |

|

| | Operations Experience: Directors with a background in overseeing the management of an organization’s operations, including expertise in areas such as process optimization and quality control. | |

|

| | M&A/Capital Markets Experience: Directors with experience in strategic planning and business development with direct responsibility for and/or overseeing collaborations and deals, including mergers, acquisitions, divestitures, joint ventures and other partnerships. | |

|

| | Corporate Governance/Regulatory Experience: Directors who possess experience on public company boards and have a deep appreciation for the dynamics between a board, management, and a company’s stockholders, along with an understanding of important legal and compliance matters. | |

|

| | Risk Management Experience: Directors with expertise in identifying, managing and mitigating risks, such as cybersecurity and information security risks, and providing valuable insight into the Board’s role in risk oversight. | |

|

| | REIT/Real Estate Industry Experience: Directors with knowledge of and experience in the real estate and REIT industries, providing valuable insights into the industry and potential issues, opportunities and emerging trends. | |

|

| | Financial/Accounting Experience: Directors with deep financial literacy and understanding of capital markets, financing, funding operations and accounting, bringing valuable insights to financial reporting, capital allocation, and other key financial decisions the Board plays a role in. | |

|

| | ESG Experience: Directors who possess experience with evolving social and environmental issues, such as human capital and sustainability. | |

|

| | Marketing/Communications Experience: Directors who have expertise in leading and executing marketing and communications strategies, as well as enhancing a company’s reputation with its key stakeholders. | |

|

| | | | | | FRANKLIN BSP REALTY TRUST | | 17 | | 2023 PROXY STATEMENT |